Medicare Annual Enrollment Period

We want to make sure you have all the resources and support you need to choose the best healthcare coverage. Understanding your Medicare options is important, and we’re here to make it easy and stress-free.

We want to make sure you have all the resources and support you need to choose the best healthcare coverage. Understanding your Medicare options is important, and we’re here to make it easy and stress-free.

UCare has announced that their Medicare Advantage plans will end after December 31, 2025. Your current plan will continue through the end of this year, but you’ll need to choose a new plan during AEP to maintain coverage in 2026, including benefits like dental and vision.

You can continue your care with us, and our team is here to answer questions and guide you to the right resources.

The Heppner Group is a team of Medicare experts that have been helping guide Minnesotans with their Medicare choices for over 40 years. They are a free, trusted resource to help you compare your options and ensure you've made an informed choice to receive the care and coverage you deserve.

For more information, call Heppner at (651) 237-3572 8am-4pm CT or click the button below to learn more.

Herself Health and Heppner are independent practices with no financial interest in the other party

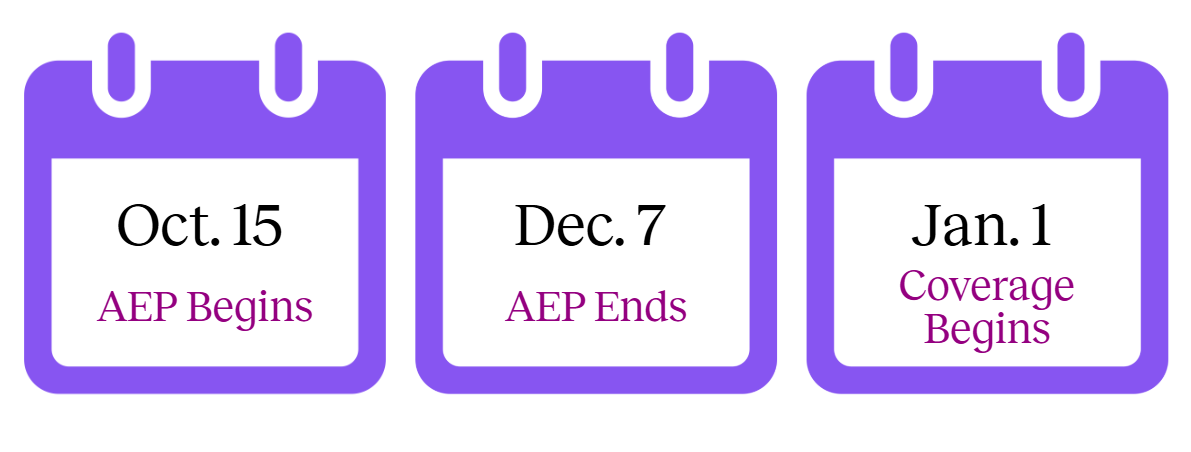

The Annual Enrollment Period for Medicare runs from October 15 to December 7. This is your opportunity to review and make changes to your Medicare plan for the upcoming year.

Explore our resources, and if you're considering other plans, our Patient Service Liaisons can connect you with the right support. We're here to make sure your healthcare coverage fits your needs perfectly.

Medicare Made Simple

Every Monday October 6th – December 1st, 10am – 2pm, in-person at all Clinic Locations

Have questions about Medicare? We’ve got answers. Join us for a relaxed, open house-style event where Licensed Independent Agents will be available to provide clear, personalized guidance on your Medicare options. Whether you're new to Medicare, exploring plan changes, or just want to understand your benefits better, this is your chance to get expert help—no appointment needed!

UCare Patient Information Sessions

October 16th at 11am and October 23rd at 3pm, Virtual

Learn more about Ucare exiting the Medicare Advantage market and what it means for you. Presented by the Heppner Group

The Annual Enrollment Period (AEP) is the time each year when you can make changes to your Medicare coverage. Whether you’re considering switching to a Medicare Advantage plan or updating your Part D prescription drug plan, this is the time to ensure your coverage matches your current health needs.

Start by reviewing your current Medicare plan. Are all your healthcare needs covered? Are there any new health concerns that need to be addressed? We’re here to help you assess your current coverage and identify any gaps.

Use our tools and resources to compare Medicare Advantage and Part D plans. Consider factors like cost, coverage, and whether your preferred doctors and pharmacies are in-network.

If you want to explore other options, now is the time to do it. Our Patient Service Liaisons can connect you with resources or licensed brokers who will help you review your choices and find the plan that's best for you.

Medicare is the federal health insurance program for people aged 65 and up. Understanding the different parts of Medicare is the first step in choosing the right coverage for your health needs.

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Most women over 60 qualify for premium-free Part A, but it’s important to understand what’s covered to avoid unexpected costs.

Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. This is a critical part of your healthcare, especially for ongoing health maintenance and managing chronic conditions.

Medicare Advantage plans offer an alternative to Original Medicare, often including extra benefits like vision, dental, and wellness programs. As your healthcare partner, we can help you evaluate if a Medicare Advantage plan is right for you.

Part D provides coverage for prescription medications, which is especially important as we age. We’ll help you compare plans to ensure your prescriptions are covered at the lowest possible cost.

Medigap policies help pay some of the healthcare costs that Original Medicare doesn’t cover, like copayments, coinsurance, and deductibles. These plans can offer peace of mind by covering the gaps in your Medicare coverage.